how much is inheritance tax in georgia

Learn everything you need to know here. Georgia Estate Tax and Georgia Inheritance Tax.

Inheritance Tax Here S Who Pays And In Which States Bankrate

Georgia inheritance law governs who is considered an heir or how assets are passed down when someone dies.

. As of 2021 the six states that charge an inheritance tax are. These states have an inheritance tax. As of 2014 Georgia does not have an estate tax either.

All inheritance are exempt in the State of Georgia. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Who has to pay.

For 2020 the estate tax exemption is set at 1158 million for. Titles and tags can be obtained at your County Tag Office for a vehicle that has been inherited or purchased from an estate. The major difference between estate tax and inheritance tax is who pays the tax.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is. The following information is required. Georgia has no inheritance tax but some people refer to.

Georgias estate tax for estates of decedents with a date of death before January 1 2005 is based on federal estate tax law. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. New residents to Georgia pay TAVT at a rate of 3 New.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. If the total Estate asset property cash etc is over 5430000 it is subject to the. An inheritance tax is usually paid by a person inheriting an estate.

After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. The state of Georgia eliminated its estate tax effective July 1 2014 and has no inheritance tax. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or.

Inheritance tax rates differ by the state. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. More on Taxes and.

There are NO Georgia Inheritance Tax. How much can you inherit without paying taxes in 2020. Click the nifty map below to find the current rates.

The estate tax is paid based on the. State inheritance tax rates range from 1 up to 16. Inheritance tax usually applies when a deceased person lived or owned property in a state.

There is no federal inheritance tax but there is a federal estate tax.

Inheritance Taxation In Oecd Countries En Oecd

What Is Inheritance Tax Probate Advance

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

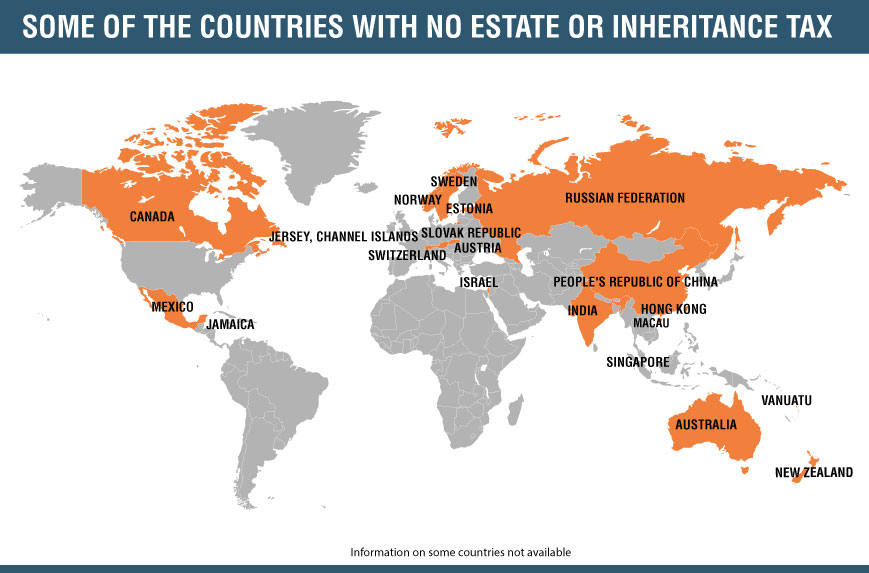

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Georgia Estate Tax Everything You Need To Know Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Inheritance Tax Here S Who Pays And In Which States Bankrate

State Death Tax Is A Killer The Heritage Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Georgia Estate Tax Everything You Need To Know Smartasset

Studies In The Regulation Of Economic Activity A Voluntary Tax New Perspectives On Sophisticated Estate Tax Avoidance Paperback

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of Last Will And Testament Will And Testament Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die